The online CPG market is becoming omnichannel

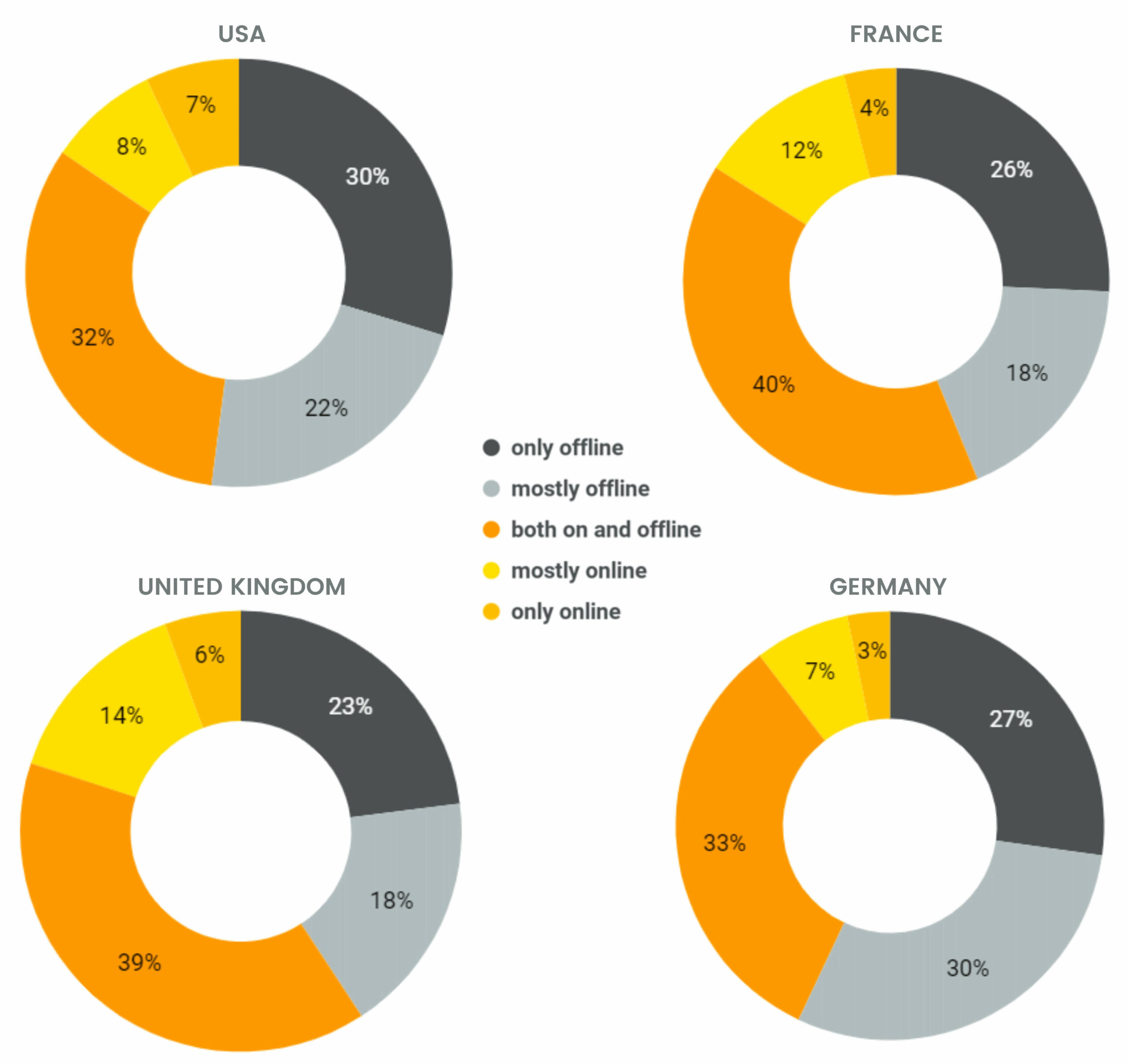

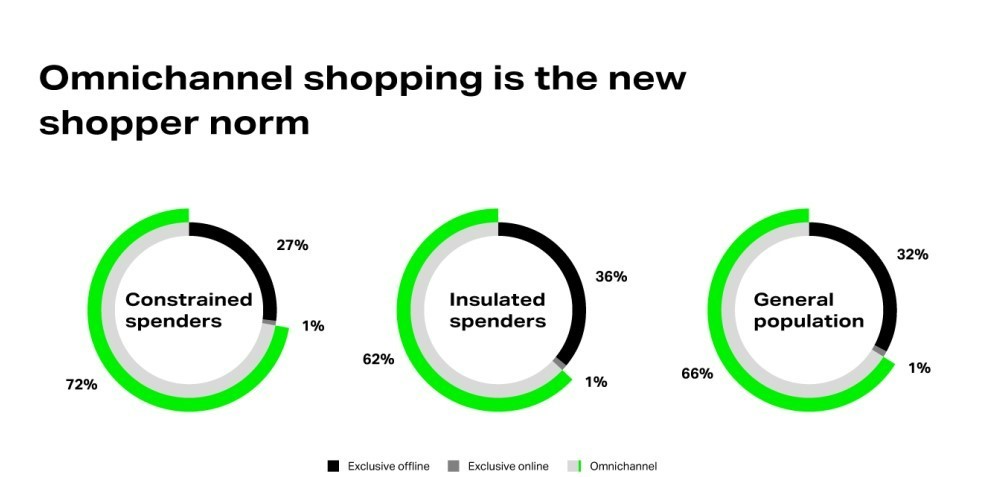

As more and more consumers turn to the internet for a portion or all of their grocery shopping, online and offline have merged into the consumer-centric omnichannel market.

Table of Contents

The growth of online CPG into the omnichannel

Covid has accelerated a transition to online grocery shopping.

“74% of global retail and consumer brand professionals said they expect the crisis-led rise in online shopping to become permanent in an October survey fielded by Euromonitor International.”

The shopping journey has now become more complex, with consumers comparing prices and items and commentaries on different sites and platforms. To retain or increase sales and maintain customer loyalty, manufacturers need to ensure that consumers have a seamless and consistent experience with their products across all online and offline interactions.

China: one the most advanced online to offline markets

Asian ecommerce markets are the most mature in the world. Chinese chains like Coop at Home with 389 online stores and LeShop with 163 stores are leading the way in bringing consumers into physical stores through digital platforms.

The US CPG ecommerce market

In America online grocery got a bit of a late start but the market is quickly catching up. Walmart now has 4,743 online stores, Amazon Fresh now counts 11 grocery stores in addition to its massive online business and delivery network, and Kroger offers over 2,000 pickup locations and 2,400 delivery locations in the U.S.

France, the birthplace of the click & collect model

The population distribution in France keeps delivery too expense for it to go mainstream, however the BOPIS and click and collect models are mature. The country’s largest chain, Leclerc, has 784 “drives” or click and collect stores, Intermarché has 1695, Carrefour 1228 and Courses U 873.

The UK CPG online market: the most mature in europe

In the UK, online grocery is shifting from a warehouse to a store-based model as brick and mortar stores find value in their proximity to consumers everywhere. Asda has 713 online stores, Morrisons Click And Collect has 447 locations, Tesco has 378 and Sainsburys, 337.

Related content

Advanced strategies for maintaining the Amazon Buy Box

Explore this article where we uncover actionable strategies for consumer packaged goods (CPG) brand manufacturers to maintain and leverage their Amazon Buy Box status effectively. Winning the Buy Box is just the beginning; sustaining this achievement requires ongoing attention and strategic insight.

A CPG brand manufacturer’s guide to understanding the Amazon Buy Box

In this blog article, we discuss the Amazon Buy Box’s importance for CPGs, its impact on product visibility and sales, and strategies for winning it. Gain insights and tactics to navigate AMZ’s competitive landscape successfully, empowering your ecommerce journey.

Webinar recording : Successful Tactics for Enhanced Visibility and Conversion on Digital Shelves

In today’s competitive market, maintaining visibility is key for brands. Join our webinar and learn strategies to optimize product listings, images, and descriptions for higher search rankings and attract more customers. Discover how AI tools can align your content with search engine algorithms.

Mastering digital shelf optimization for CPG success

This brief guide delves into the essence of digital shelf optimization, offering CPGs nuanced insights and strategies to improve product sales on retailer sites.

Retailer-specific SEO recipe UK

Appearing among the top search results on a retailer’s website is crucial as it increases brand visibility and ensures that the brand stays at the top of the shopper’s mind.

This guide shows how the criteria for search results vary at different UK retailers for the cereal category.

Content Advisor

Our latest feature, Content Advisor, employs artificial intelligence (AI) to automatically provide you with optimized suggestions for product titles and descriptions. Powered by ChatGPT, this advanced AI model generates compliant titles and descriptions based on predefined recommendations.

Don't miss a thing !